top of page

High-risk merchant account

High-Risk International Payment Gateways Shaping the Digital Era

As digital commerce expands across borders, businesses operating in high-risk sectors face a challenge that goes far beyond simple payment acceptance. Forex trading platforms, online gaming operators, digital subscription services, and regulated online businesses all require payment infrastructure that can handle international transactions, compliance requirements, and elevated risk exposure. By 2026, the role of high-risk international payment gateways has evolved significan

Pay cly

Jan 83 min read

Trust, Privacy & Payments: The New Reality of Online Dating After 2026

Online dating has changed dramatically over the past decade. What began as simple profile browsing has evolved into subscription-driven platforms offering premium visibility, virtual gifts, boosts, and recurring memberships. While user experience and matching algorithms improved quickly, payment infrastructure often lagged behind. Looking at online dating payments through a before-and-after 2026 lens reveals how trust, privacy, and conversion rates are now deeply tied to how

Pay cly

Jan 33 min read

Why Contactless Payments Are Now the Default, Not a Feature

Contactless payments didn’t take over because they were impressive. They took over because they stopped getting in the way. For consumers, paying has become something that should barely register. A tap, a glance, a biometric confirmation — and the transaction is complete. Anything slower now feels outdated, regardless of how secure or “robust” the system behind it may be. This shift has quietly rewritten the rules of modern commerce. For merchants — especially those selling g

Pay cly

Dec 24, 20254 min read

Glocal Payments: How Modern Businesses Balancing Global Reach With Local Preferences

In today’s interconnected digital economy, selling internationally is no longer reserved for large enterprises. Even niche subscription platforms, high-risk industries, and digital businesses can operate across multiple regions from day one. Yet, global reach brings its own challenges — especially when it comes to payments. Consumers expect seamless, familiar, and secure checkout experiences, no matter where they live. This is where glocal payments — the fusion of global pay

Pay cly

Dec 22, 20254 min read

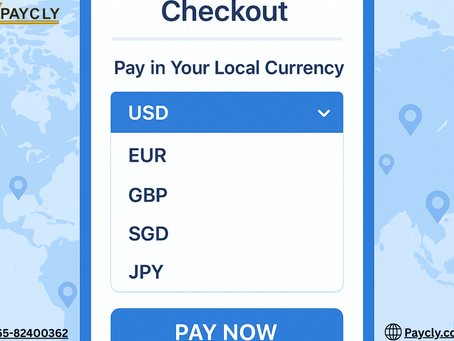

Why Local Currency Pricing Matters and How PayCly Makes It Easy

Multi-currency payment option is a simple feature that helps businesses sell globally with trust, clarity, and confidence. If you sell products or services to customers outside your country, you’ve probably seen this happen at least once: A customer reaches your checkout page…They’re ready to pay…But they suddenly stop because the price is in a foreign currency they don’t fully understand. This is a common issue for businesses using online merchant accounts , credit card pa

Pay cly

Dec 12, 20253 min read

How to Make High-Risk Merchant Accounts Fast, Easy & Secure with Paycly

Running a high-risk business can open doors to massive opportunities—but it also brings unique challenges. One of the biggest? Payment processing. Strict underwriting, higher chargeback risks, compliance rules, and industry restrictions can make getting approved for a high-risk merchant account feel like climbing a mountain. But here’s the good news: It doesn’t have to be that way. PayCly is reshaping how high-risk businesses get approved, accept payments, and grow worldwide.

Pay cly

Dec 3, 20252 min read

bottom of page