Why Local Currency Pricing Matters and How PayCly Makes It Easy

- Pay cly

- Dec 12, 2025

- 3 min read

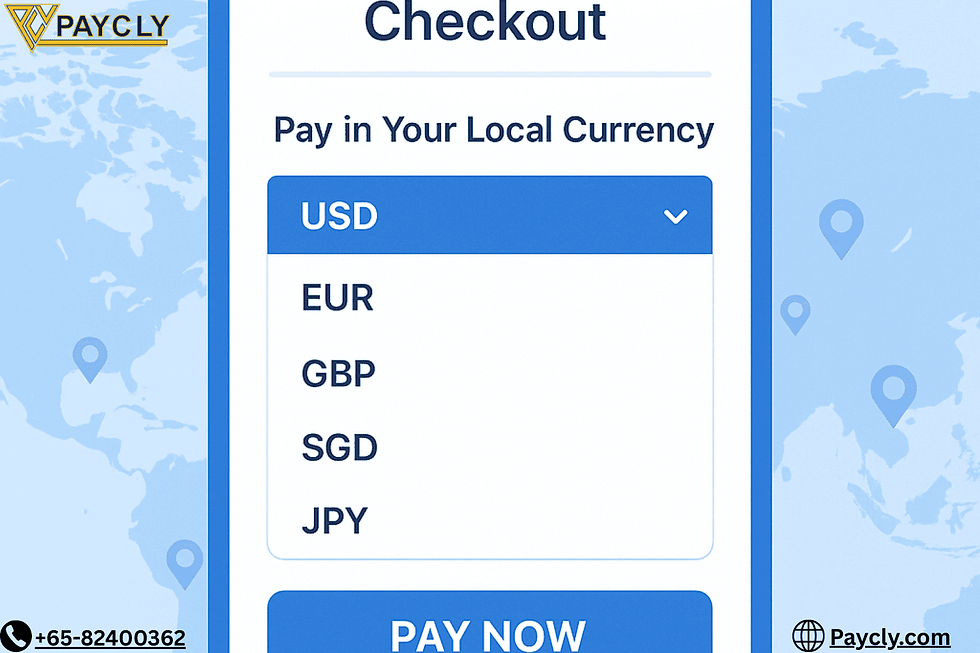

Multi-currency payment option is a simple feature that helps businesses sell globally with trust, clarity, and confidence.

If you sell products or services to customers outside your country, you’ve probably seen this happen at least once:

A customer reaches your checkout page…They’re ready to pay…But they suddenly stop because the price is in a foreign currency they don’t fully understand.

This is a common issue for businesses using online merchant accounts, credit card payment solutions, or international payment gateways.

Customers fear hidden fees, bank charges, or currency fluctuations—and that hesitation often leads to lost sales.

This is exactly where PayCly’s multi-currency support becomes a powerful advantage for growing global businesses, especially those handling high-risk merchant accounts, forex merchant accounts, gaming merchant accounts, or online dating merchant accounts.

Let’s break this down in a simple way.

1. Customers Trust What Feels Familiar

Think about how you feel when you shop online.

If you’re from the UK, seeing a price in GBP feels comforting.

If you’re from Japan, ¥ feels normal and safe.

If you’re from the UAE, AED gives clarity.

Your customers feel the same.

Showing prices in their local currency instantly reduces confusion—whether they are using a credit card, an alternative payment method, or paying through a high risk payment gateway.

With PayCly, businesses can accept payment online in 100+ currencies, making global buyers feel like they’re purchasing locally. When people feel safe, they hit “Pay” with confidence.

2. Clear Pricing = Lower Cart Abandonment

One of the biggest reasons customers leave checkout pages is uncertainty about the final amount. Here’s what PayCly merchants have observed:

Fewer questions about “unexpected bank fees”

Fewer refunds and chargebacks

A smoother experience for international customers

Whether you’re running a forex platform, a gaming website, a subscription service, or even a high risk business, clarity at checkout increases completed payments.

3. Real Merchant Stories That Show the Impact

a). A SaaS Business in Singapore.

They were only charging in USD. Customers from the UK, UAE, and Australia hesitated at checkout.

After enabling multi-currency with PayCly:

People started buying faster

International orders increased

Support complaints about pricing disappeared

Sometimes the smallest change makes the biggest difference.

b). A European Gaming Platform Expanding to Asia

Gamers in Japan and South Korea were interested but unsure because of USD-only pricing. With PayCly’s multi-currency and gaming merchant account support:

Players paid easily in JPY and KRW

The platform saw a noticeable rise in successful payments

Average player spending went up

When customers don’t have to “think twice,” they complete the purchase.

c). A Forex Broker Onboarding Global Traders

Forex traders take pricing seriously. Even a slight difference matters. Using PayCly’s forex merchant account and multi-currency system:

Traders deposited funds in their local currency

Trust increased

Signups grew rapidly

Clear pricing builds credibility in sensitive industries like trading.

4. People Spend More When They Understand the Price

This is not a business trick—it’s human nature. Customers feel more comfortable spending when:

The price is clear

The currency is familiar

There are no surprise conversions

PayCly’s experience shows that average spending often increases when merchants allow local currency payments through their credit card merchant account or global payment processing setup.

5. Multi-Currency Makes You Look More “Global Ready”

Customers judge a business quickly. If your website only accepts USD, it feels restricted. If your website accepts local currencies, it feels modern, international, and customer-friendly.

Whether you handle:

High risk payment processing

Casino or adult merchant accounts

Gaming or forex payment processing

Online dating merchant accounts

Standard credit card payments

…multi-currency support immediately improves your brand perception. You look like a business that understands global buyers.

6. PayCly Makes It Simple for Merchants

You don’t need to be a developer or payment expert. PayCly helps you:

Accept credit card payments in multiple currencies

Offer local and alternative payment options

Reduce friction for international buyers

Improve conversions with transparent pricing

Handle high risk business processing smoothly

Integrate easily with your website or app

Whether you're just entering global markets or already serving international customers, PayCly gives you a cleaner, smarter way to accept payments online.

Final Thoughts

Businesses that sell internationally grow faster when they remove friction from checkout.

With PayCly’s multi-currency support, you can:

✔ Build trust ✔ Improve transparency ✔ Reduce abandoned carts ✔ Increase global conversions ✔ Serve customers in their own currency ✔ Accept payments online easily and securely

From credit card payment solutions to high risk merchant accounts, PayCly supports all industries—forex, gaming, adult, casino, dating, SaaS, eCommerce, and more.

Comments