top of page

High-Risk International Payment Gateways Shaping the Digital Era

As digital commerce expands across borders, businesses operating in high-risk sectors face a challenge that goes far beyond simple payment acceptance. Forex trading platforms, online gaming operators, digital subscription services, and regulated online businesses all require payment infrastructure that can handle international transactions, compliance requirements, and elevated risk exposure. By 2026, the role of high-risk international payment gateways has evolved significan

Pay cly

Jan 83 min read

Why Contactless Payments Are Now the Default, Not a Feature

Contactless payments didn’t take over because they were impressive. They took over because they stopped getting in the way. For consumers, paying has become something that should barely register. A tap, a glance, a biometric confirmation — and the transaction is complete. Anything slower now feels outdated, regardless of how secure or “robust” the system behind it may be. This shift has quietly rewritten the rules of modern commerce. For merchants — especially those selling g

Pay cly

Dec 24, 20254 min read

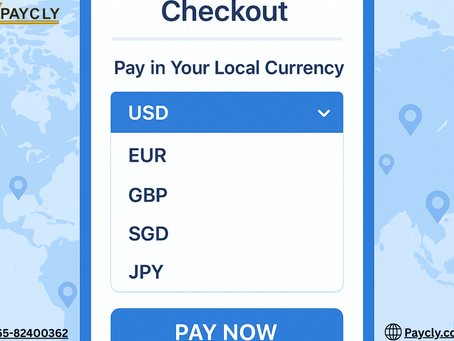

Why Local Currency Pricing Matters and How PayCly Makes It Easy

Multi-currency payment option is a simple feature that helps businesses sell globally with trust, clarity, and confidence. If you sell products or services to customers outside your country, you’ve probably seen this happen at least once: A customer reaches your checkout page…They’re ready to pay…But they suddenly stop because the price is in a foreign currency they don’t fully understand. This is a common issue for businesses using online merchant accounts , credit card pa

Pay cly

Dec 12, 20253 min read

bottom of page